This series of articles seeks to examine the character attributes of highly successful leaders, regardless of their adherence to a strong faith or moral standard. In presenting these thoughts, Leadership Ministries is not agreeing with or advocating these traits or practices, but rather presents these as ideas for discussion and development in your own leadership journey.

Warren Buffett is CEO of Berkshire Hathaway and is considered one of the most successful investors on earth. He has a net worth of over $160 billion (May 2025), placing him in the top 10 of the world’s wealthiest individuals. Buffett was born in Omaha, Nebraska and his investment company is headquartered there. He is also one of the world’s most notable philanthropists, having pledged to give away 99% of his fortune to nonprofit causes. He founded The Giving Pledge in 2009 with Bill Gates, whereby billionaires pledge to give away at least half of their fortunes.

Buffett began his business life modestly with a job at investor Benjamin Graham’s partnership in 1956 earning $12,000 a year. He purchased a five bedroom house in Omaha in 1957 for $31,500 and still lives in the same home today. Through astute investing Buffet was a millionaire by 1962. It was in that year that he merged his various partnerships into what became Berkshire Hathaway. Buffett became a billionaire when Berkshire Hathaway began selling class A shares on May 29, 1990. In 2008 he was for a time the richest person in the world with a net worth of $62 billion. People who know him describe Buffett kindly: Smart. Humble. Funny. Approachable. Honest.

Though he now prefers Google and an iPhone, until the mid-2010s Buffett did not use a smart phone or email, or keep a computer on his desk. He still doesn’t use a calculator, as he has a talent of being able to compute numbers in his head. He reads five newspapers every day. Here are some of the leadership characteristics that Buffett uses to guide the investments of Berkshire Hathaway:

Delegate. Buffett believes one pillar of successful leadership is delegation. He establishes trust with his team and then empowers his employees auth authority. Marcel Schwantes writes for Inc. Magazine of Buffett, “The key is always to hire the right people first, train them well, push decisions down the organization, and then resist the temptation to be involved with details. Putting this trust and power in the hands of workers is critical to success.”[1]

In a 2015 letter to shareholders, Buffett commented, “Much of what you become in life depends on whom you choose to admire and copy.” As an investor, Buffett spends much time observing the work of other CEOs and applying their best management skills to his own companies. An example is Tom Murphy, CEO of Capital Cities Communications in the 1990s and greatly admired by Buffett. Murphy was known for both delegating authority and holding his managers accountable for their performance. Buffett has applied both of these principles at Berkshire Hathaway in part based on Murphy’s example. His leadership style, which eschews micro-management in favor of a “hands off” approach, is sometimes called “Laissez-Faire” leadership.[2]

Warren Buffett originally purchased his house in Omaha, Nebraska for $31,500. He has upgraded the home but still lives in it. Photo: Berkshire Hathaway

Own up to mistakes. Buffett personally writes the annual reports for Berkshire Hathaway, explaining in detail his investment decisions. He is not the perfect strategist, and he will openly acknowledge mistakes. This helps employees understand that leaders like Buffett are humans, and that they are not on another level from them.[3] When one investment lost money, Buffet commented, “Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.”

Buffett believes that this kind of honesty in business is a mark of great integrity, which he weighs above all traits when building a company. Buffett said, “We look for three things when we hire people. We look for intelligence, we look for initiative or energy, and we look for integrity. And if they don't have the latter, the first two will kill you, because if you're going to get someone without integrity, you want them lazy and dumb.” While not every leader shows common sense, Buffett gives the opportunity for his to improve on their daily decision-making by copying the sensible and high-integrity habits of others around them who have it. High degrees of honesty and trustworthiness at all levels are among the attributes that give investors confidence in trusting Buffett with their fortunes.

Be a mentor. Buffett says, “Never invest in a business you cannot understand.” A leader should be able to guide his workers to the right path and toward informed decision-making. To achieve their goals, the leader should be a great influencer for the employees. Warren Buffett works to be a mentor and influencer in his companies. When he entered business school in 1951, Buffett absorbed lessons from his favorite book, “The Intelligent Investor”, written by Benjamin Graham in 1949. Graham was a professor of economics at Columbia University and considered one of the first activist investors.

Buffett’s annual Letter to Shareholders details how he picks his investments. His writings on this are studied by thousands of investors worldwide, and have been compiled into a book. Photo: Berkshire Hathaway

Graham said, “An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.”[4] This sensible approach to investing, which looks carefully at the bottom line and fundamentals of a company while avoiding spending money on emotion or speculation, has become a key characteristic of Buffett’s business model. These principles are among those that Buffett himself passes along to his employees through his mentoring.

Patient and calm. In the often-frantic atmosphere of investing, Buffett is well known as a calm and patient leader whose goals for his companies are long-term. He advises his shareholders not to buy businesses with the intent of selling them, commenting, “Do not take yearly results too seriously. Instead, focus on four or five-year averages.” Since 1965, Berkshire Hathaway has provided an average 19% return, almost double that of the S&P 500.[5] In the 1960s you could buy Berkshire Hathaway shares for $7.50 each. Today a class A share trades for nearly $300,000. Buffett says, “Successful investing takes time, discipline, and patience. No matter how great the talent or effort, some things just take time.”

[1] https://www.inc.com/marcel-schwantes/warren-buffett-says-all-successful-leaders-have-one-thing-in-common.html

[2] https://sites.psu.edu/leadership/2013/11/10/laissez-faire-leadership-and-warren-buffett/

[3] https://financhill.com/blog/investing/warren-buffett-leadership-style

[4] https://medium.datadriveninvestor.com/the-father-of-value-investing-and-his-best-disciple-the-story-of-benjamin-graham-and-warren-buffet-e08ef3bac09e

[5] http://www.lazyportfolioetf.com/comparison/warren-buffett-vs-us-stocks/

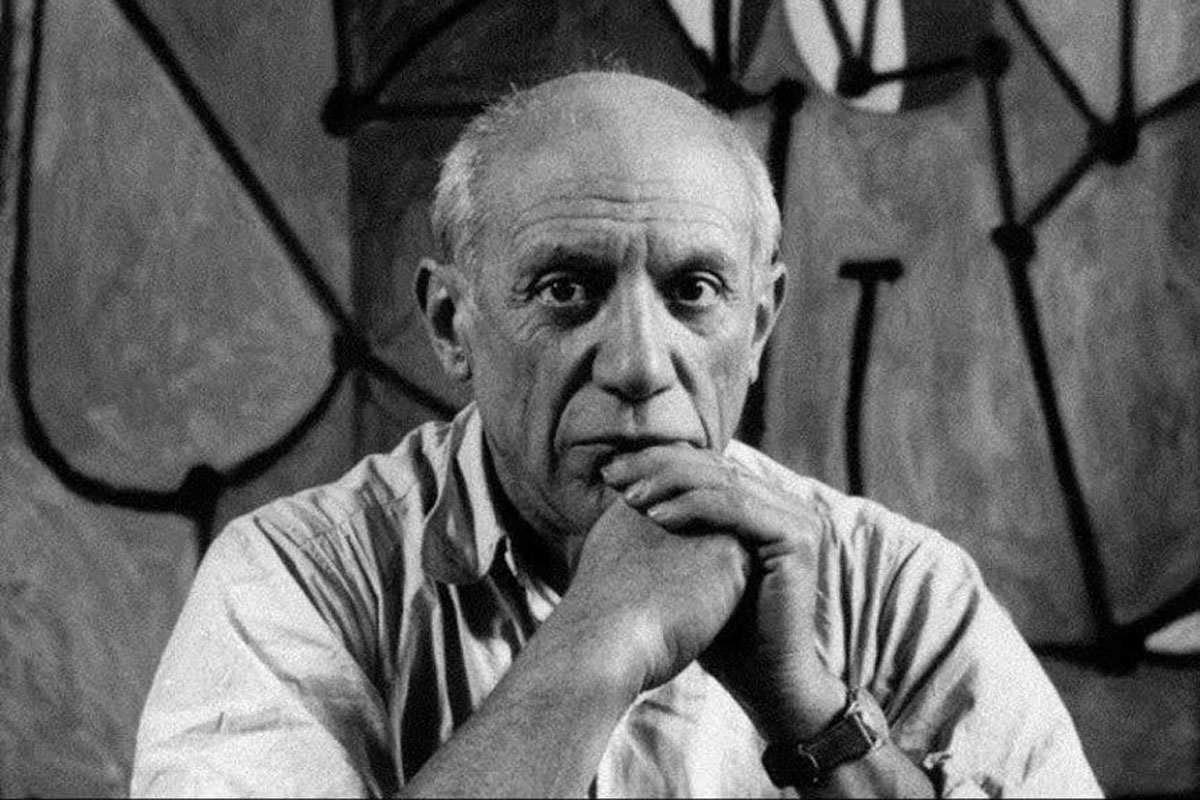

Cover photo: Berkshire Hathaway

Frank Winfield Woolworth was an American entrepreneur, and founder of the F. W. Woolworth Company. He pioneered the retail variety stores which featured low-priced merchandise selling for 5 and 10 cents.